The Bursa Equity market has not been kind for the past 3 weeks. As per my last posting on 4th May, the reason we have not been posting regularly is

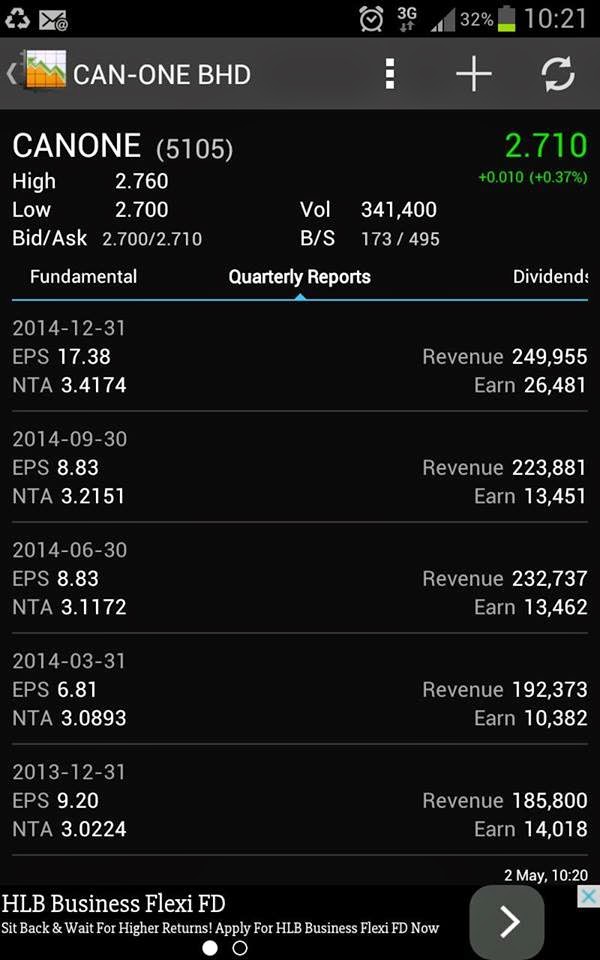

1st Pending for the Quarterly Result for 2015

2nd Direction from 1st Quarter Result that leads to our investment decision for the next few months.

So far the reports are generally NOT ENCOURAGING. Those FA, TA and Contra Kaki Chatroom has been quiet down. Most of the people get caught especially in the penny stocks trading.

Most of the reports have been announced. So, what's next?

1. Avoid Political Link Counters

2. Avoid Counters with No Fundamentals

3. Avoid Counters without the Theme Play (Properties & Commodities)

The good part is, be prepared to nibble some good counters when the month to be rolled over to June.

We believe with the current index, we may find some good shares to be invested.

=)