Company Profile

MIKROB is a listed small cap led and founded by Mr. Yim Yuen Wah in 1997. I found some of the criteria I like in this company and believe it will be her next catalyst.

What Mikrob do?

Extracted from Annual Report:

Manufacture and sale of analogue, digital, and computer controlled electronic devices for the purpose of protection, monitoring, and programming in electrical systems. Its products include protective relays, such as overcurrent (OC), earth fault (EF), earth leakage, combined OC and EF, voltage and current control, and reverse power relays; digital meters, including ammeters and voltmeters; current transformers; and power factor regulators. Mikro MSC Berhad also provides related technical support and maintenance services.

Why I like this company?

She has fulfill all 4 requirements that I am looking for and has a good growth story.

1st Theme Play

Needless to say, 2nd half 2015 is Export Play and I believe it will be carried forward to 2016 at least for another few months. For year 2015, she has been able to increase the export sales to Vietnam, India, Indonesia and Australia by 67%. The export done is bearing fruits for her. The current weakening of RM against the US dollar is beneficial to the Group because she derived 37% of the revenue of the company in export.

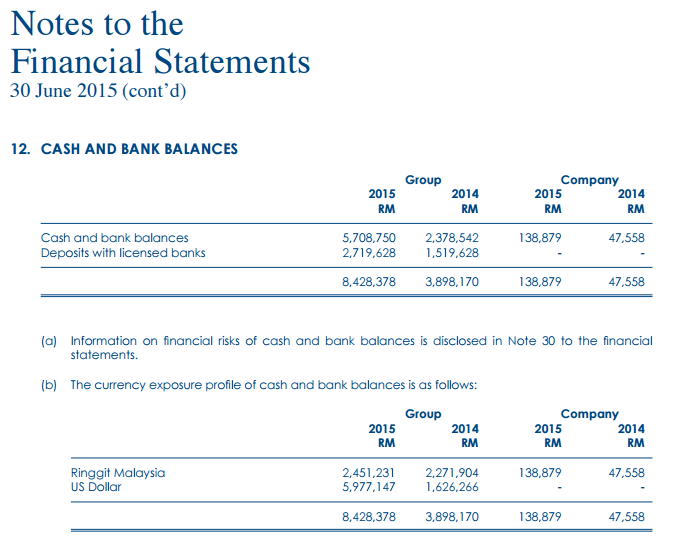

Look at the Cash USD in deposits for year 2014 @ RM 1.6m vs 2015 @ RM5.9m. A jumped of RM4.3m. Bear in mind, the 2015 Annual Report was published for Year End June 2015. The USD sharp spiked up was from July 2015 onwards and started to contribute to 1st Quarter 2016 results. What do you think for 2nd, 3rd and 4th Quarter of 2016? =)

2nd Financial Health Analysis

Income Statement

Profit Margin = 21% - pass (<5% fail)

14% for year 2011 to 21% year 2015 – increasing every year without fail

Interest Cover = 127x - pass (<3x fail)

Profit for the past 5 years = Yes, steadily grow from RM3.4m year 2011 to RM8.26m year 2015

Balance Sheet

Current Ratio = 5.4x – pass (<1x fail)

Debts to Equity Ratio = 0.17x – pass (>3x fail)

Cash Flow

Positive at least 1 year = Pass - Yes from RM3.9m to RM8.4m

MIKROB PASS ALL 6 FINANCIAL HEALTH RATIOS!

3rd. Pricing Analysis

Price to Earnings –

Using the Rolling 4 Quarters EPS: 3.084 = 0.415/3.084 = 13.4x (not cheap but acceptable)

Forecast Future PE by using 1st Quarter 2016 and annualized it by X4 = 1.01x4 = 4.04

Forecast Future P/E = 0.415/4.04 X 100 = 10.3x

Looking at current USD/MYR exchange rate, possible for her to repeat the 1st Quarter 2016 result.

Price to Book Value – 2.88x (not cheap but acceptable)

Dividend Yield – 2.67% (for Ace market this is consider good, she has been paying good dividends since 2011 which most Ace could not make it)

Do look at her Compounded Annual Growth Rate (CAGR) for Revenue. 10.6% average for the past 5 years. It looks very good for an Ace counter like her. Most of the main board companies also cannot maintain their CAGR in double digit growth. What makes me even like her more? Look at her CAGR for Profit After Tax (PAT). It is at a staggering 19.4% for the last 5 years! Talking about consistent high growth for her! (extracted from Annual Report)

4. 3 Catalysts for 2016:

1. The main catalyst which really catches my eyes for possible long term investment is the adoption of M2M (Machine 2 Machine) connectivity and IoT (Internet of Things). MIKROMB is embracing this technological change, not only because it is inevitable but also because it promises new frontiers and rewards.

2. She just bought a piece of freehold industrial land together with a single storey warehouse, for a total cash consideration of RM11,720,000 for business expansion earlier this month. This was following through with the Private Placement done on 22 Dec 2015 with RM10m raised for their business war chest. Monies raised from the placement definitely will be a great usage to operate the new warehouse in 2016 and improve the following few 2016 Quarterly Report results.

3. Potential to be upgraded to Main Board. (this is what I like)

PAT for 2014 = RM 5.6m

PAT for 2015 = RM 8.2m

1st QR 2016 = RM 2.8m (annualized for 4 Quarters will be RM11m)

Under Bursa Main Board listing requirement, latest 3 years PAT must be minimum RM 20m with the latest Financial Year not less than RM6m. Looking at this scenario, she just need another 2 quarters to make it. Theoretically she already strong and fit to join the bigger boys in Main Board.

Conclusion & Personal Opinion:

I like the strong management team and solid fundamental numbers recorded. As now the market is focusing on export play, I believe with the 3 catalysts she has, it is a good stock to watch for 2016. The potential of upgrading to Main Board and export theme play definitely makes her a sexy stock to watch out.

Potential risks involved are the slowdown in Malaysia economy as she derived about half of her revenue in Malaysia and fluctuations on USD currency.

Please like us at our facebook page - Bursa Blue Ocean and complete the survey form and join out telegram group chat room!

Sincerely,

Humble Pie

Disclaimer and Declaration

The information is meant for the members of Bursa Blue Ocean (BBO). Disclosure and distribution of the message without the permission of BBO is prohibited. The full content of the article and write ups are for educational purposes only and should not be used as investment recommendations. We are not responsible for all investment activities conducted by the participants and cannot be held liable for any investment loss.