Dear Readers,

This stock was recommended by one of our group members and I find it quite interesting:

Credit to Mr. Koo.

P/E = 6.48 PASS

P/BV = 0.79 PASS

Dividend Yield = 1.85% FAIL

Profit Margin = 7.9% PASS

ROE = 17% PASS

Current Ratio = 1.35 PASS

Quick Ratio = 1.01 PASS

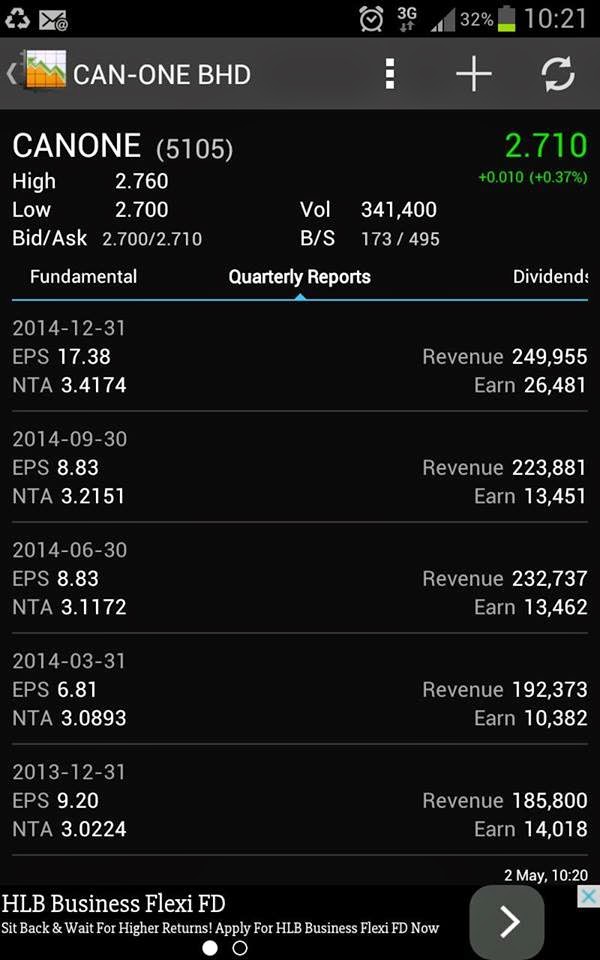

From all the quick analysis, CAN ONE only fails Dividend Yield. Looking at the Quarterly Report, the NTA has been growing steadily Quarter after Quarter. Performances has been stable.

With the recent Quarterly Report announced and the P/E has dropped to 6, it is a good catch. Downside risk is limited. The only concern is the Major Litigation within Can One, Dato See is challenging the GO of Kian Joo. Looking into this, the price more or less has been priced in.

Normally for a main board company, the P/E ratio should be around 10x.

If let's say we peg the P/E to 10x:

EPS 42 x PE 10 = RM 4.20

We give 30% haircut on the pricing = RM 2.94.

Looking to gain around 8~10% from this counter.

If the price goes against me, I am ready to hold this counter.

This stock was recommended by one of our group members and I find it quite interesting:

Credit to Mr. Koo.

P/E = 6.48 PASS

P/BV = 0.79 PASS

Dividend Yield = 1.85% FAIL

Profit Margin = 7.9% PASS

ROE = 17% PASS

Current Ratio = 1.35 PASS

Quick Ratio = 1.01 PASS

From all the quick analysis, CAN ONE only fails Dividend Yield. Looking at the Quarterly Report, the NTA has been growing steadily Quarter after Quarter. Performances has been stable.

With the recent Quarterly Report announced and the P/E has dropped to 6, it is a good catch. Downside risk is limited. The only concern is the Major Litigation within Can One, Dato See is challenging the GO of Kian Joo. Looking into this, the price more or less has been priced in.

Normally for a main board company, the P/E ratio should be around 10x.

If let's say we peg the P/E to 10x:

EPS 42 x PE 10 = RM 4.20

We give 30% haircut on the pricing = RM 2.94.

Looking to gain around 8~10% from this counter.

If the price goes against me, I am ready to hold this counter.

Disclaimer and Declaration

The full content of the article is for educational purposes only and should not be used as investment recommendations. We are not responsible for all investment activities conducted by the participants and cannot be held liable for any investment loss. Examples of specific shares may be citied for

illustration purposes.

illustration purposes.

Regards,

Humble Pie

No comments:

Post a Comment