Dear Readers,

Selamat Hari Raya to all Muslim friends in Malaysia! While enjoying a cup of latte, I am browsing through an interesting company with 3 years of listing record.

Today sharing will be a bit different. Generally sifus will be using Fundamentals to analyze a company moving forward for their future growth. My 2 cents are included other factors for sharing purposes.

1. Management Team / Major Shareholders:

i. Bear in mind, good company is run by Great People. The brains and movers behind. If the bosses are reliable and generally sincere in doing business, you shall see their words/promises are kept.

Back to May 2012 IPO, if you browse through their Annual Report, one weird issue generally normal people won't notice, Pestech's Principle Advisor is Bank Islam. Why Bank Islam and not the other Investment Banks that are Small and Mid Cap IPO Specialist? Personally I guess if they are engaging 'The Small Cap IPO Specialist', the IPO valuation might be slightly better considering their ability/database available to push the Private Placement to Institutional Clients.

Bank Islam is one of the best practitioner of Shariah Principle in Malaysia and it carries a premium in the eye of our Muslim Institutional Funds and Muslim Investors. An engagement with Bank Islam generally it carries the understanding of prudent business.

ii. For the past 2 years, the CEO/ED Mr. Lim Pay Chuan has been buying back his own shares. He is doing Dividend Reinvestment Plan too. For lay man like us, dividend means income from investment received. For him to exercise this activity, he himself would not be getting monies from the dividends declared, only shares. For this idea to be successful, the owners must have confident with their own listed vehicle to continously generating good profits.

iii. A lot of young investors have not heard about Share Grant Plan (SGP). SGP is different from ESOS. ESOS is to be given to staffs who work about 3 years and above for their loyalty and a scheme to hold the staff for another few years. SGP is free shares to be rewarded base on achievement/KPIs met.

2. Fundamental Analysis

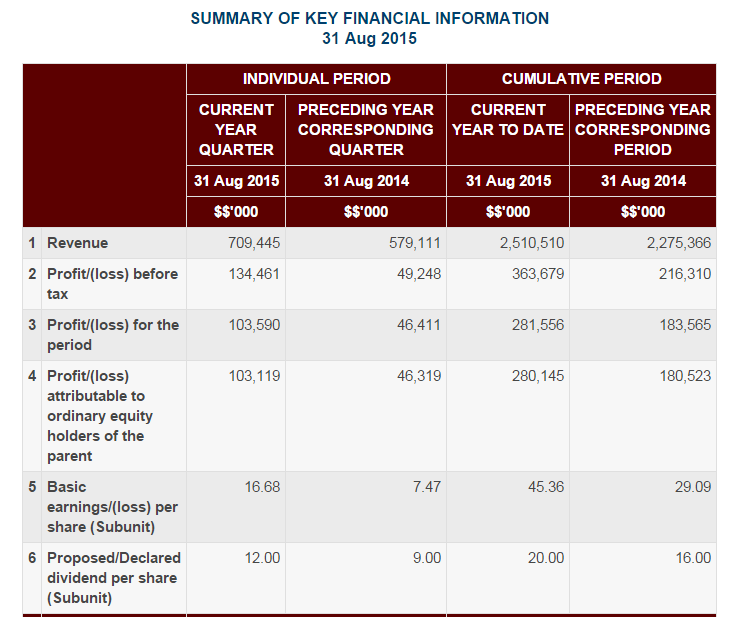

Sept 14 + Dec 14 + Mac 15 = EPS of 22.29 for 3 Quarters

(22.29/3) X 4 = 29.72 (annualized 4 Quarters)

Price 5.15 / 29.72 = PE 17x

For the pricing, definately it is not cheap. Comparable to PE for FD of 18X.

3. Economic / Industry

Pestech's business rely on Tenaga a lot. For the past few years they have diversified to few countries especially Cambodia and their reputation there is recognize by the government. They have reduced their dependancy to Tenaga for the past few years. I would not want to touch the FA in details, you may read it @

http://www.bursamarketplace.com/index.php?ch=44&pg=158&ac=16504&bb=research_article_pdf

TP: 6.11

Being a construction company focusing on utilities, this sector are generally defensive and niche. For their competitors to emulate what Pestech can do, it is tough.

4. A quick glance on their shareholdings, Mr. Lim Ah Hock and Lim Pay Chuan controls more than 55% of the shares. Inclusive of their Directors and Friendly Institutional Funds who enjoy the ride for the past 3 years, I believe collectively they can reach up to 75% of the public spread. As long as the bosses keeps on accumulating from the market, I believe he would not bring me to Holland. Sellling the shares to institutional I believe it part of their strategy to introduce their company to Foreign Institutional Funds as they are actively involving business in Asean Market.

Conclusion:

PE 17x is not cheap. For those investors looking for a very safe and high dividend yield stock, this is not for you. For investors who are willing to look at this counter, do prepare to hold mid to long term with less dividends given (it is normal for construction company to give less dividends). Personally I am monitoring this counter, if the bosses keep accumulating from the open market even though it touches RM5, I do not mind to follow his foot steps.

I believe Pestech is joining the billionaire club soon.

Disclaimer and Declaration

The full content of the article is for educational purposes only and should not be used as investment recommendations. We are not responsible for all investment activities conducted by the participants and cannot be held liable for any investment loss. Examples of specific shares is citied for illustration purposes.

Regards,

Humble Pie