Company Profile

1. 3x Cash Call in 4 Years

In a short span of 4 years of listing (2012 to 2016), she already did 2x of cash call and now calling for the 3rd round. The 3rd and latest round of cash call was announced in June 2016. What actually happened?

For a listed company, the main reason for an IPO is to sell/place out min 25% of their enlarged shareholding to raise cash (to meet the minimum 25% public spread). The cash raised should be sufficient to cater for the next few years business expansion purposes.

Surprisingly;

i. 2 years post listing, RM74m was raised through 'Private Placement' on June 2014

ii. The subsequent year, RM132m was raised though 'Right Issue' on Dec 2015

iii. The following year, they announced the 3rd round of fund raising exercise on June 2016

Extracted from Bursa Malaysia, 'Company Announcement' column;

For a simplistic calculation, let's say I am taking the last closing price @ 5/8/2016 which is RM0.83 and multiply by 105.6m shares, the amount to be raised will be RM87m. (Generally, to do a Placement, PVWAP of 5 days will be used).

Raising so much of funds via Equity do dilute the shares and EPS, moreover it is barely 4 years old in Bursa. Many Investment Managers definitely will raise their eye browse on this. Let's map the chronology of the fund raising:

Fundraising i:

Fundraising iii:

For 2nd cash call:

There is a balance of 87.3% to be used for business expansion which I believe for Myanmar's Project.

What to look at for OCK?

Net profit has tripled for the past 5 years. From a RM9.2m to Rm27.1m. Talking about consistent high growth for her!

She has touched the resistance level @ 0.84 for the 7th time! Talk about long consolidation. Look at the triangle (blue line) recording Higher Low for the last 6x support level. The latest few days closed with a high volume. Something to see for technical chartist?

For those who likes to see for a longer time frame, lets look at below, it might look interesting for you. It is trading at the new high, trying to break the old resistance set in July 2014 ! Wonder what would it be in the near future ? =)

Disclaimer and Declaration

The information is meant for the members of Bursa Blue Ocean (BBO). Disclosure and distribution of the message without the permission of BBO is prohibited. The full content of the article and write ups are for educational purposes only and should not be used as investment recommendations. We are not responsible for all investment activities conducted by the participants and cannot be held liable for any investment loss.

OCK is founded and led by Mr. Ooi Chin Koon in year 2000 (OCK Setia Engineering Sdn Bhd) and listed on Bursa Ace Market in year 2012. I guess now you can see where the 'OCK' name come from. =)

From 2000 to 2012, it is not bad for a cool 12 years from 0 to a listed entity right? It took another 2 short years for OCK to upgrade herself from ACE to Main Market (20m PAT in 3-5 years with the latest financial year not less than RM6m PAT).

From 2000 to 2012, it is not bad for a cool 12 years from 0 to a listed entity right? It took another 2 short years for OCK to upgrade herself from ACE to Main Market (20m PAT in 3-5 years with the latest financial year not less than RM6m PAT).

What OCK do?

Extracted from OCK's Corporate Website:

OCK Group is principally involved in the provision of telecommunication services equipped with the ability to provide full turnkey services. Our service offering comprehensively covers services from all six segments of the telecommunication network services market: network planning, design and optimization, network deployment, network operations and maintenance, energy management, infrastructure management, and other professional services. As a Network Facilities Provider (NFP) Licensee, we are able to build, own and rent telecommunication towers and rooftop structures to the eight telecommunication operators in Malaysia.

Why I am looking at this company?

They are some info I would like to share for this stock.

They are some info I would like to share for this stock.

1. 3x Cash Call in 4 Years

In a short span of 4 years of listing (2012 to 2016), she already did 2x of cash call and now calling for the 3rd round. The 3rd and latest round of cash call was announced in June 2016. What actually happened?

For a listed company, the main reason for an IPO is to sell/place out min 25% of their enlarged shareholding to raise cash (to meet the minimum 25% public spread). The cash raised should be sufficient to cater for the next few years business expansion purposes.

Surprisingly;

i. 2 years post listing, RM74m was raised through 'Private Placement' on June 2014

ii. The subsequent year, RM132m was raised though 'Right Issue' on Dec 2015

iii. The following year, they announced the 3rd round of fund raising exercise on June 2016

Extracted from Bursa Malaysia, 'Company Announcement' column;

PROPOSED PRIVATE PLACEMENT OF UP TO 105,632,181 ORDINARY SHARES OF RM0.10 EACH IN OCK REPRESENTING APPROXIMATELY TEN PERCENT (10%) OF THE ISSUED AND PAID-UP SHARE CAPITAL OF OCK ("PROPOSED PRIVATE PLACEMENT").

Raising so much of funds via Equity do dilute the shares and EPS, moreover it is barely 4 years old in Bursa. Many Investment Managers definitely will raise their eye browse on this. Let's map the chronology of the fund raising:

Fundraising i:

It was being done at the same time /year with the acquisition of PT Putra Telecommunications in Indonesia.

A new venture to overseas business.

Fundraising ii:

The 2nd cash call was being done at the same time /year with the acquisition of 920 telecommunications towers contract from Telenor Myanmar. Another new country she ventured in.

The 3rd cash call was being done at the same time /year with the acquisition of SEATH (owned 1938 towers in Vietnam. Another new country she is venturing in.

Look at how the money flows as at 1st Quarter of 2016:

For 1st Cash Call:

There is a balance of 16.11% to be used. The mandate to utilize the money has expired on June 2016. I believe OCK has fully utilized the 100% of the 1st cash call for now.

Look at how the money flows as at 1st Quarter of 2016:

For 1st Cash Call:

There is a balance of 16.11% to be used. The mandate to utilize the money has expired on June 2016. I believe OCK has fully utilized the 100% of the 1st cash call for now.

For 2nd cash call:

There is a balance of 87.3% to be used for business expansion which I believe for Myanmar's Project.

What to look at for OCK?

1st Growth Catalyst: Potential Improvement of Earnings from Indonesia & Myanmar

Monies already spend but earnings only started to crystallized. This is to say, monies spend since year 2014 has starting to yield the positive numbers to the top and bottom line of the latest QR Report. For the funds raised in cash call 2 has yet being fully utilized. Believe it will give a further boast in their upcoming QR Reports. The overseas venture done is bearing fruits for her. During the Indonesia acquisition, it was 6000 sites, 2 years later it is 20000 sitess. Not bad at all.

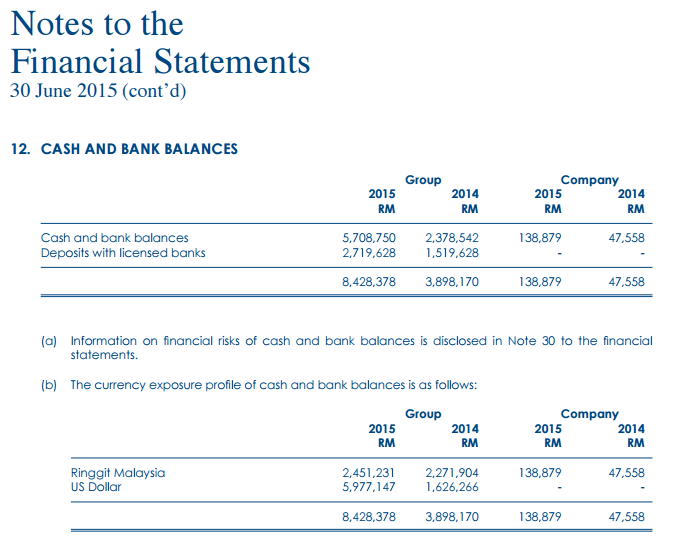

The current weakening of RM against the US dollar is beneficial to her as well. What do you think for the upcoming 2nd, 3rd and 4th Quarter of 2016 numbers would be ? =)

Please refer below of the details highlighted in blue:

Monies already spend but earnings only started to crystallized. This is to say, monies spend since year 2014 has starting to yield the positive numbers to the top and bottom line of the latest QR Report. For the funds raised in cash call 2 has yet being fully utilized. Believe it will give a further boast in their upcoming QR Reports. The overseas venture done is bearing fruits for her. During the Indonesia acquisition, it was 6000 sites, 2 years later it is 20000 sitess. Not bad at all.

The current weakening of RM against the US dollar is beneficial to her as well. What do you think for the upcoming 2nd, 3rd and 4th Quarter of 2016 numbers would be ? =)

Please refer below of the details highlighted in blue:

2nd Financial Health Analysis

Income Statement

Profit Margin = 7.84% - pass (<5% fail)

Interest Cover = 4.31x - pass (<3x fail)

Profit for the past 4 years = Yes, steadily grow from RM13.15m year listing year 2012 to RM24.75m in year 2015

Balance Sheet

Current Ratio = 3.32x – pass (<1x fail)

Debts to Equity Ratio = 0.59x – pass (>3x fail)

Cash Flow

Positive at least 1 year = Pass - Yes from RM12m (2012) to RM164m (2015)

OCK PASS ALL 6 FINANCIAL HEALTH RATIOS.

3rd. Pricing Analysis

Price to Earnings:

Using the Rolling 4 Quarters EPS: 3.197 = 0.83/3.197 = 26x (not cheap at all)

Looking at continuous income from Indonesia and Myanmar, it should be better for the few upcoming quarters.

Price to Book Value – 1.95x (not cheap but acceptable)

Dividend Yield – 1.45% (for a company in high expansion mode, any dividends payout is a bonus)

Do look at her Compounded Annual Growth Rate (CAGR) for Revenue and PAT (extracted from Annual Report):

Do look at her Compounded Annual Growth Rate (CAGR) for Revenue and PAT (extracted from Annual Report):

Net profit has tripled for the past 5 years. From a RM9.2m to Rm27.1m. Talking about consistent high growth for her!

4. Catalysts for 2016:

1. The main catalyst which catches my eyes for possible long term investment:

The consolidation of income from Seath Vietnam. Assuming 2016 yield about the same like 2015: 60% of 2015 PAT of RM7.44m will be around RM4.5m added in to the bottom line.

The additional incoming revenue from Indonesia and Myanmar. Monies raised from the upcoming placement definitely will be a great usage to improve the following few 2016 Quarterly Report results.

Technical Chart Perspective:

The consolidation of income from Seath Vietnam. Assuming 2016 yield about the same like 2015: 60% of 2015 PAT of RM7.44m will be around RM4.5m added in to the bottom line.

The additional incoming revenue from Indonesia and Myanmar. Monies raised from the upcoming placement definitely will be a great usage to improve the following few 2016 Quarterly Report results.

Technical Chart Perspective:

For those who likes to see for a longer time frame, lets look at below, it might look interesting for you. It is trading at the new high, trying to break the old resistance set in July 2014 ! Wonder what would it be in the near future ? =)

Conclusion & Personal Opinion:

I like the strong management team lead by Mr. OCK and solid fundamental numbers recorded. As now the company has been in the overseas business for the 3rd year, I believe the numbers will be good for the near future. Let's hope that the name OCK also stands for Orang Cepat Kaya.

Potential risks involved are the slowdown in Malaysia economy as most of her revenue currently still in Malaysia and fluctuations on USD currency (Indonesia, Myanmar and Vietnam's Project). For those conservative FA followers, this stock might not be suitable for you as it has a high valuations. I am looking at 'Growth Investing' and not 'Value Investing'. Our perspective and risk tolerance might be different.

Please like us at our facebook page - Bursa Blue Ocean and complete the survey form and join out telegram group chat room!

Sincerely,

Humble Pie

Disclaimer and Declaration

The information is meant for the members of Bursa Blue Ocean (BBO). Disclosure and distribution of the message without the permission of BBO is prohibited. The full content of the article and write ups are for educational purposes only and should not be used as investment recommendations. We are not responsible for all investment activities conducted by the participants and cannot be held liable for any investment loss.